regional income tax agency estimated payments

Extension of Time to File. ESTIMATED INCOME TAX COMPUTATION and ESTIMATED PAYMENT.

Doing Business In The United States Federal Tax Issues Pwc

Regional Income Tax Agency RITA.

. Posted Wed May 6 2015 at 1153 am ET. Check your estimated payments and refund status any time. If you dont have an Online Services account see Create account.

CLEVELAND OH 44101-2004 BROADVIEW HEIGHTS. Corporations are required to pay estimated income tax if the corporations income tax less any credits for the taxable year can reasonably be expected to be 500 or more. Estimated Income Tax andor Extension of Time to File.

Typically no federal income tax is withheld from any of them. Nonresident aliens use Form 1040-ES NR to figure estimated tax. Are you required to pay estimated taxes.

5 Regional Income Tax Agency Estimated Income Tax andor. Login to MyAccount 247 to make estimated tax payments. Taxes must be paid as you earn or receive income during the year either through withholding or estimated tax payments.

5 Regional Income Tax Agency Estimated Income Tax andor. If you file on an extension your first. Estimated MTA surcharge and make installment payments.

If youd like a CCA team member to complete your municipal income tax return please fill out the CCA Division of Taxation Taxpayer Assistance Form found on the Tax Forms page of this. The Income Tax office hours are 800 am to 430 pm Monday through Friday. Estimated tax payments can be made over the phone with our 247 self-service options at 8008607482.

How Much Does Regional Income Tax Agency Pay. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. Use View and cancel scheduled payments in your Online Services account to cancel the payment.

Estimated Payment not less than 14 of Line 3 00 Note. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and. Do NOT check this box if you are only making an Estimated Tax payment.

Free Case Review Begin Online. 5 REGIONAL INCOME TAX AGENCY Net Profit. Taxpayers can use the Drop-off preparation service see below The Cincinnati Income Tax.

Based On Circumstances You May Already Qualify For Tax Relief. Of estimated tax payments and credits on your account or make a payment by calling 440-526-0900 or 800-860-7482. Ad See If You Qualify For IRS Fresh Start Program.

Estimated tax is the amount estimated to be the franchise excise or gross receipts tax and MTA surcharge for the current. Welcome to Ohios Regional Income Tax Agency RITA with a website designed to make your municipal tax administration service more easily accessible and navigable online. REGIONAL INCOME TAX AGENCY REGIONAL INCOME.

That means you may be required to make estimated tax payments. Estimated Taxes - Who Needs to Pay Them. 3rd Quarter Estimated Municipal Income Tax Payments Due September 15th.

Rita 101 Regional Income Tax In Ohio Dca Cpa S

![]()

Home Regional Income Tax Agency

Metamora Village Council Facebook

![]()

Home Regional Income Tax Agency

Home Regional Income Tax Agency

The Regional Income Tax Agency Rita

Rita 101 Regional Income Tax In Ohio Dca Cpa S

Income Tax Information Middleburg Heights

Income Tax City Of Gahanna Ohio

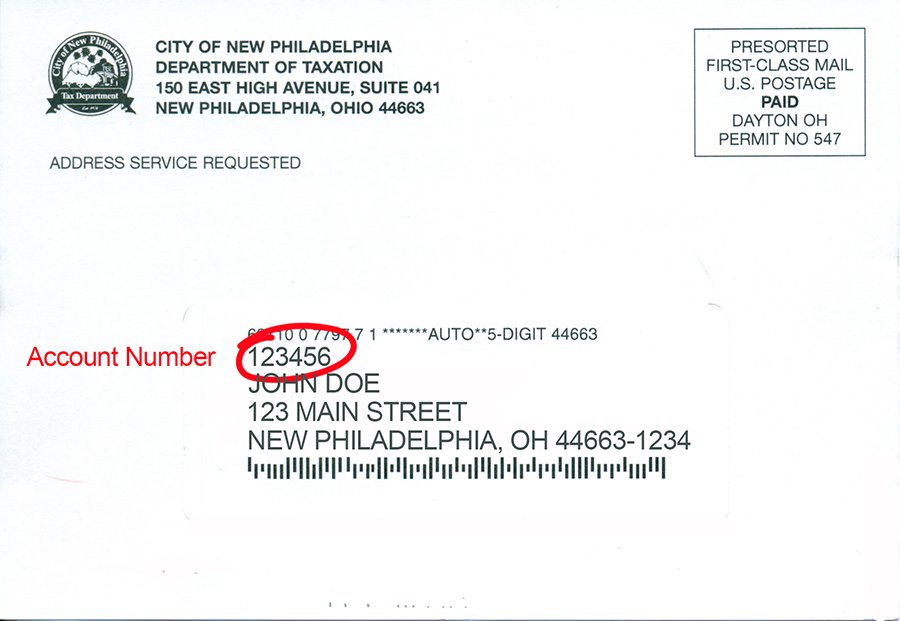

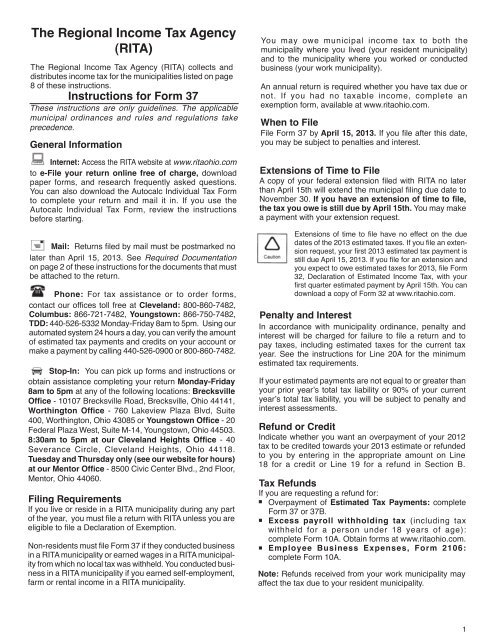

Instructions Form 37 The Regional Income Tax Agency

Income Tax City Of Gahanna Ohio

.png)