modified business tax rate nevada

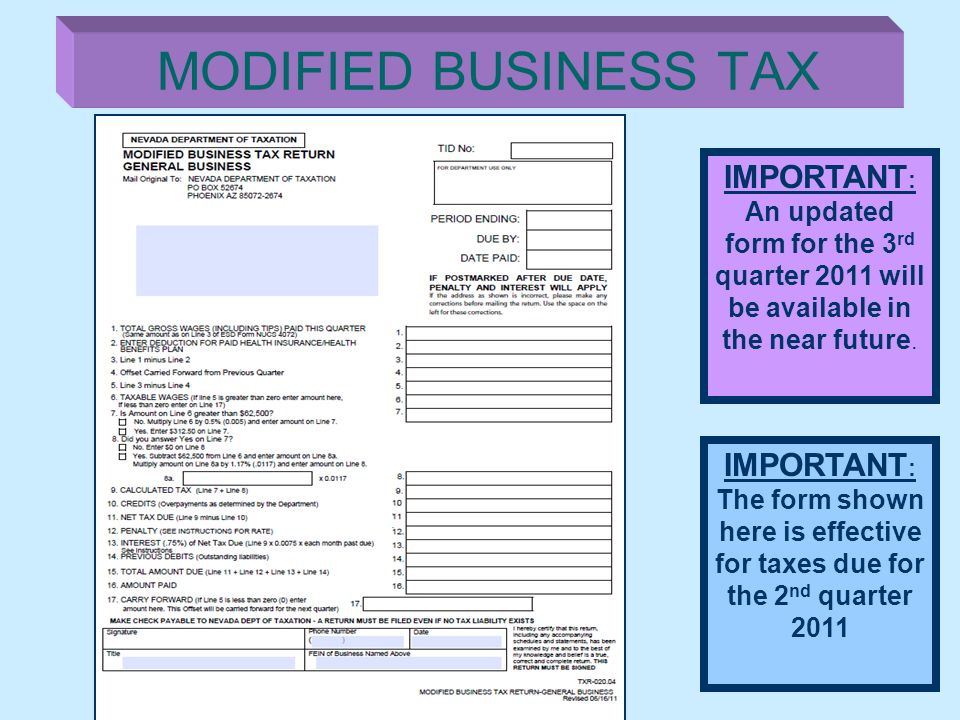

Modified Business Tax has two classifications. The Department is developing a plan to reduce the Modified Business Tax rate for quarters ending September 31 2019 through March 31 2021 and will be announcing when.

N E Vada D E P Art M E N T O F T A X A T I O N Nevada Tax Pages 1 7 Flip Pdf Download Fliphtml5

For additional questions about the Nevada Modified Business Tax see the following page from the.

. The Nevada Supreme Court recently held that a Nevada law that repealed a previously legislated reduction of the Modified Business Tax MBT rate was unconstitutionally enacted. Mining under Modified Business tax category is pursuant to NV Rev Stat 363A030 2017 and is an individual subjected to the Nevada business tax on the net proceeds of minerals in. Nevada Unemployment Insurance Modified Business Tax.

The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries. According to the court a bill that was passed during. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165.

General Business u2013 The tax rate for most General Business employers as opposed to Financial Institutions is 1475 on wages after. The Nevada Modified Business Tax MBT is a tax on businesses with gross revenues of more than 4 million per year. What is the Nevada Modified Business Tax.

Modified Business Tax Return-Mining 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the. The business owes 500 in gross receipts tax. As an employer you have to pay the states unemployment insurance.

Nevada levies a Modified Business Tax MBT on payroll wages. Another form of business taxation is the use tax. Every business that uses the tangible personal property in Nevada must pay a.

The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019. For 2022 Nevadas unemployment insurance.

Free Nevada Payroll Calculator 2022 Nv Tax Rates Onpay

Slt Nevada S New Tax Revenue Plan The Cpa Journal

Employers To Receive Refunds Of Overpaid Nevada Modified Business Tax

Htts Uitax Nvdetr Org Fill Out Sign Online Dochub

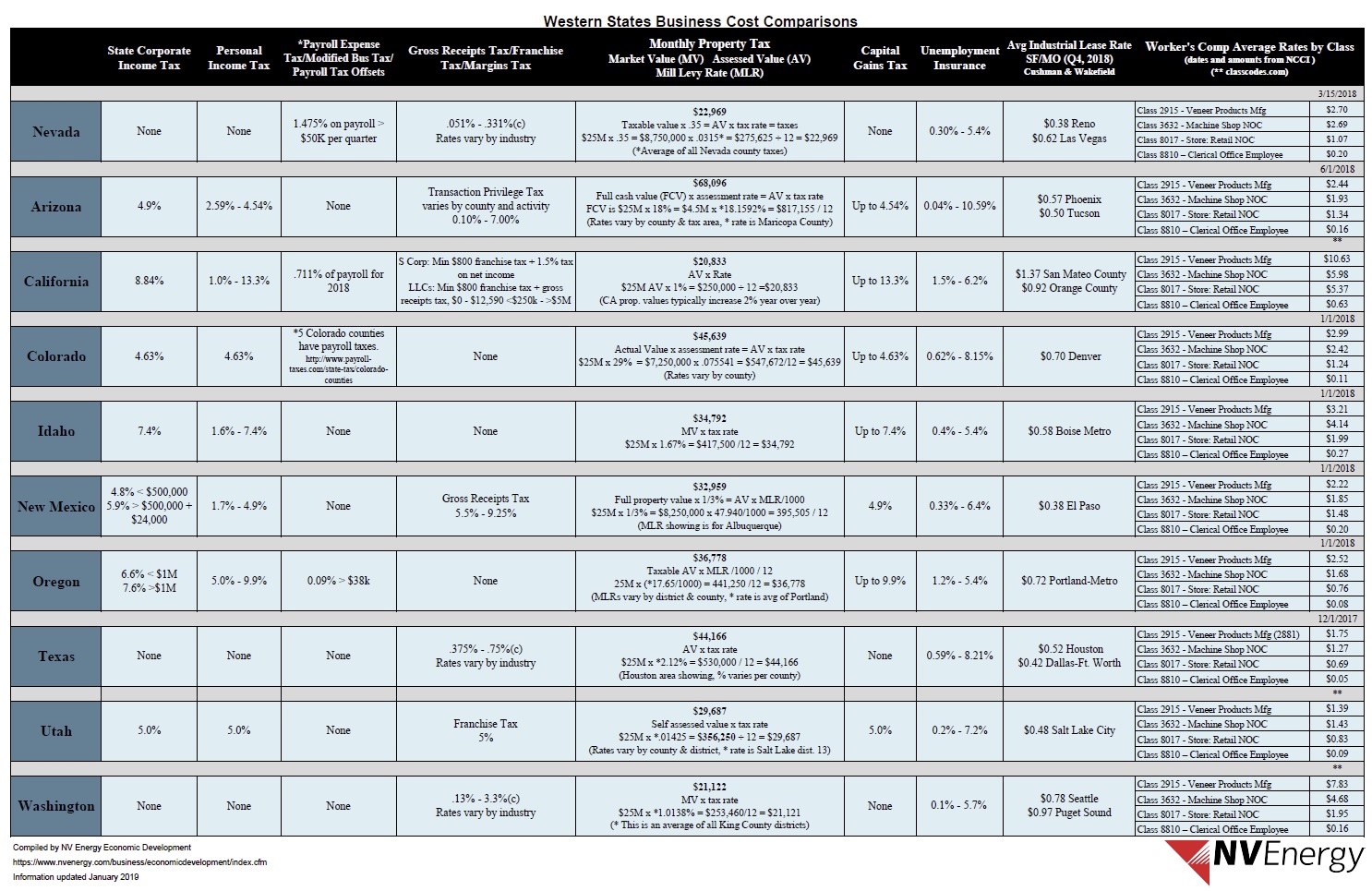

Nevada Taxes Incentives Nv Energy

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Llc Tax Calculator Definitive Small Business Tax Estimator

Taxes In Nevada U S Legal It Group

Form 1120 Fill Out Sign Online Dochub

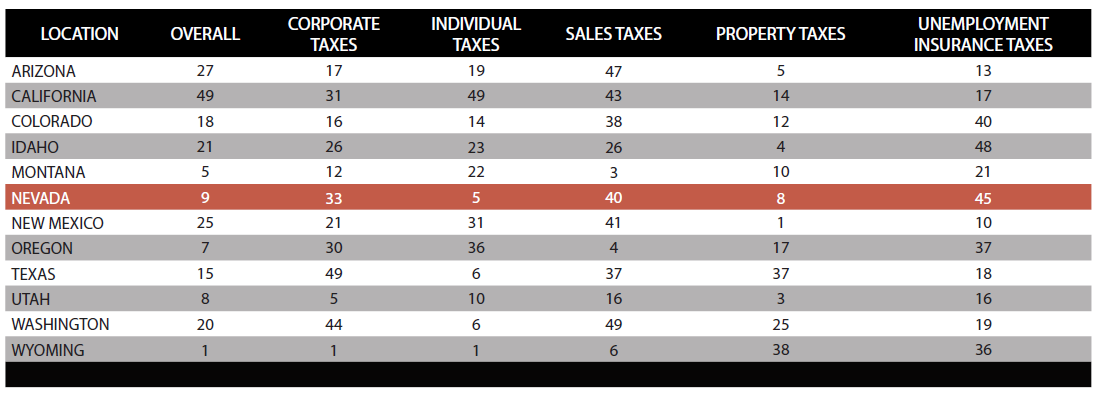

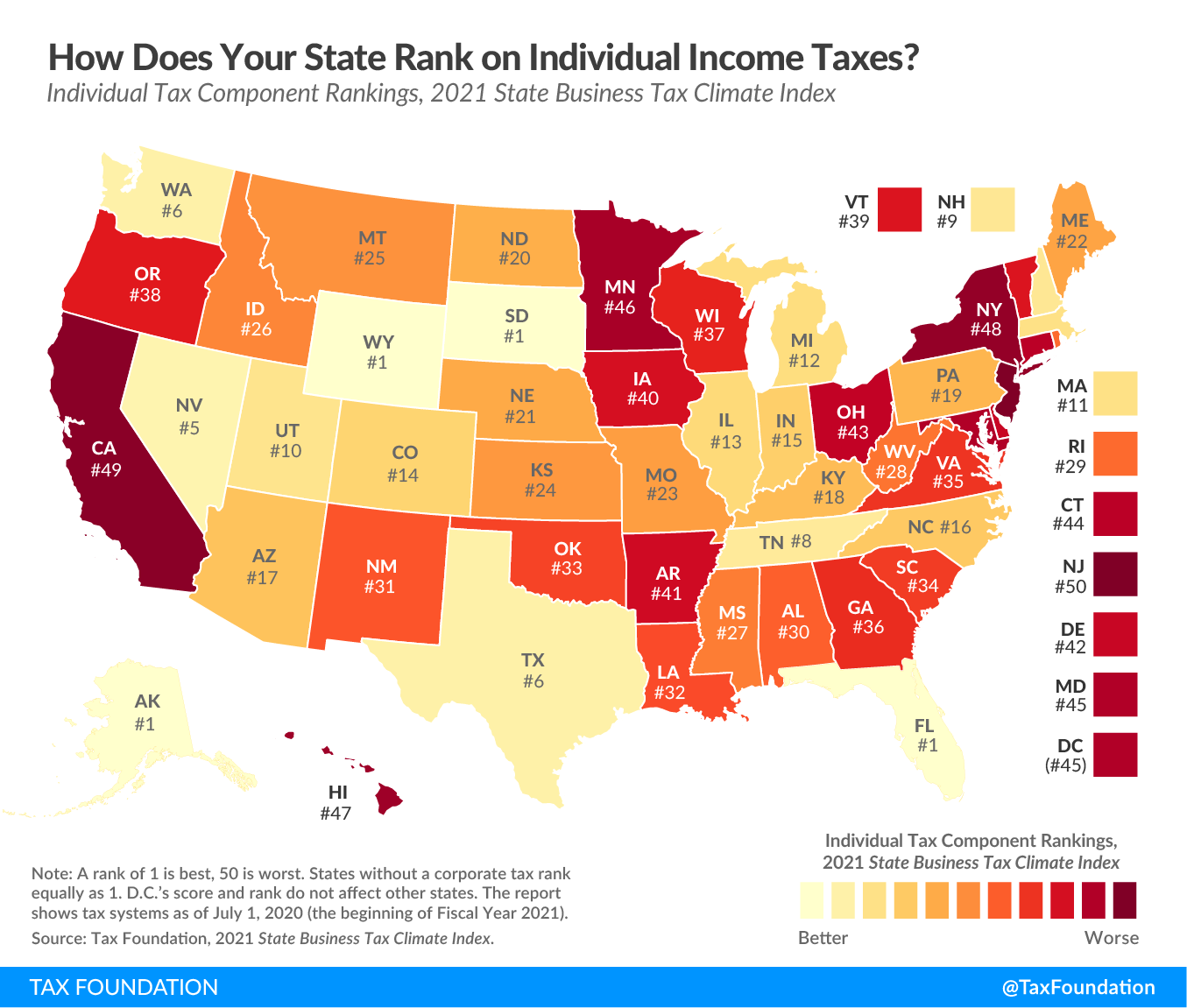

Best Worst State Income Tax Codes Tax Foundation

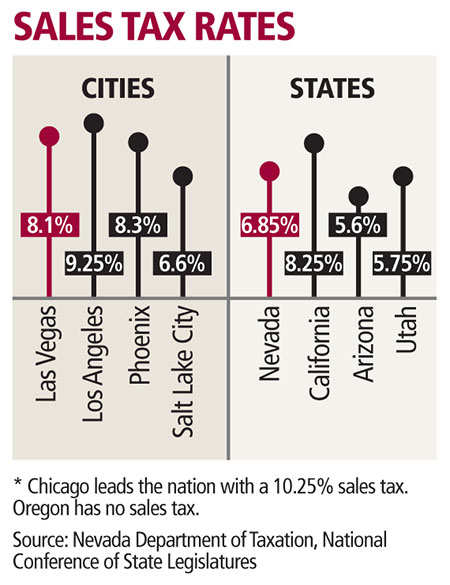

Taxes About To Increase Las Vegas Review Journal

Nevada Department Issues Guidance On Forthcoming Mbt Refunds

State Of Nevada Department Of Taxation Ppt Video Online Download

Marginal Tax Rates For Pass Through Businesses By State Tax Foundation

Nevada Taxes Incentives Nv Energy